Why Most Investors Pay 40%+ in Taxes… While the Ultra-Rich Pay 0% Legally

The IRS classifies all income into three buckets—and most people are stuck in the worst one.

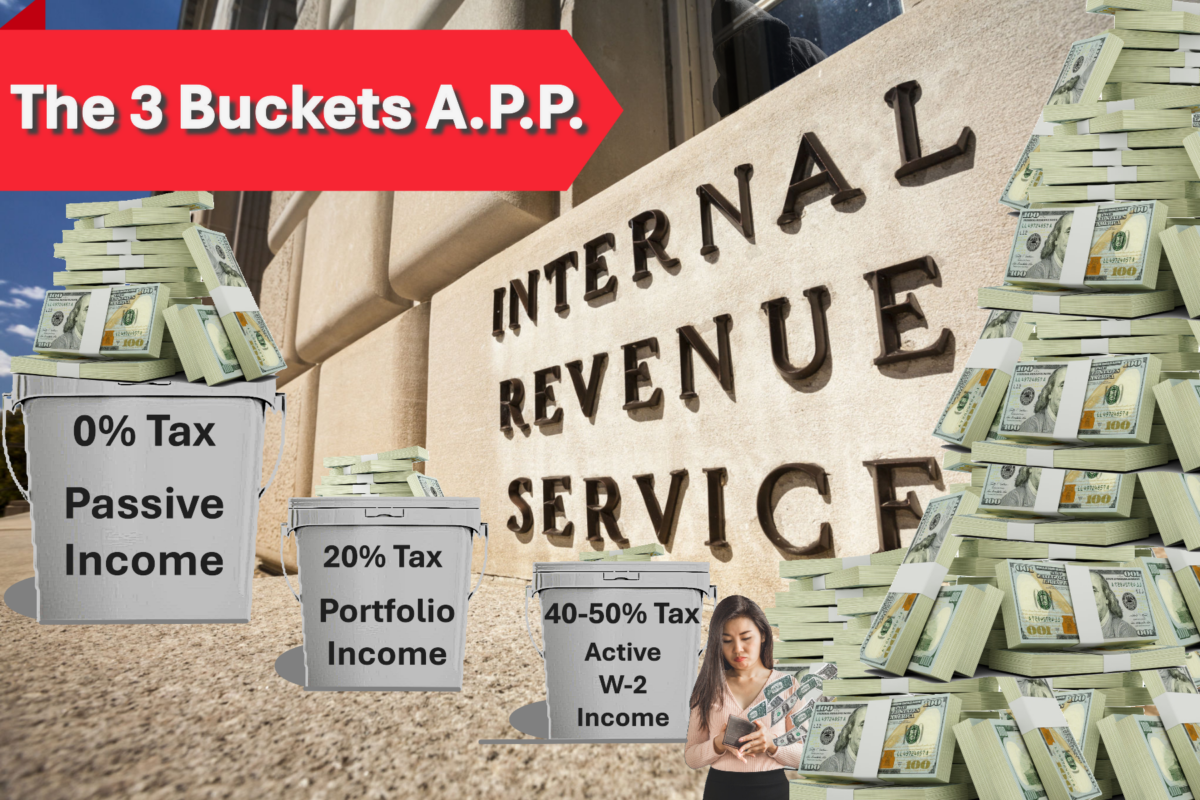

The 3 Buckets of Income

1️⃣ Active Income (W-2, Business Owners)

- Taxed at 40-50%.

- You work the hardest and pay the most.

2️⃣ Portfolio Income (Stocks, Bonds, Capital Gains)

- Taxed at 15-20%.

- Better than W-2, but still heavily taxed.

3️⃣ Passive Income (Real Estate, Private Equity, Businesses You Don’t Work In)

- Potentially taxed at 0% (due to depreciation and tax write-offs).

- The ultra-wealthy prioritize this bucket.

How to Shift Your Income into the Passive Bucket

- Invest in cash-flowing real estate.

- Use depreciation, cost segregation, and 1031 exchanges.

- Move from highly taxed W-2 work to low-tax passive income streams.